Unknown Facts About Credit Card Processing Fees

Wiki Article

Credit Card Processing Fees Things To Know Before You Buy

Table of ContentsThe Payment Hub IdeasOur First Data Merchant Services DiariesThe 20-Second Trick For Payment HubPayeezy Gateway Things To Know Before You BuyAll about Clover GoIndicators on Comdata Payment Solutions You Should KnowGetting The Clover Go To WorkThe Of Comdata Payment SolutionsA Biased View of Ebpp

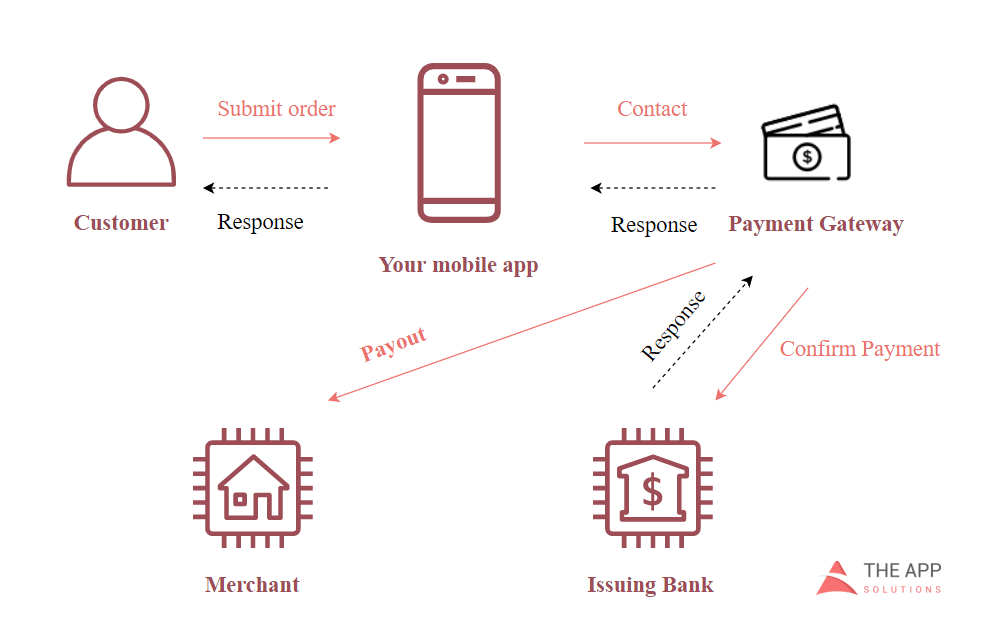

The most common issue for a chargeback is that the cardholder can not keep in mind the purchase. Nevertheless, the chargeback proportion is really low for purchases in a face-to-face (POS) setting. See Chargeback Administration.You don't require to come to be a professional, but you'll be a much better customer if you know just how bank card processing actually functions. To comprehend exactly how the payment procedure works, we'll look at the actors and their duties. Who are the stars in a credit score and debit card purchases? obtains a credit history or debit card from an utilizes the account to spend for items or solutions.

Online Payment Solutions Can Be Fun For Anyone

That's the credit history card procedure essentially. Now allow's take a look at. send out batches of certified purchases to their. The passes deal details to the that interact the ideal debits with the in their network. The charges the make up the amount of the deals. The then transfers ideal funds for the transactions to the, minus interchange fees.

The smart Trick of Payment Solutions That Nobody is Discussing

You can receive a merchant account by means of a payment processing company, an independent service provider, or a big financial institution. A settlement handling company or monetary organization deals with the purchases in between your clients' financial institutions as well as your bank.You ought to permit vendors to accessibility info from the backend so they can see background of settlements, terminations, and various other transaction information. PCI Protection assists vendors, sellers, as well as monetary organizations implement requirements for developing safe and secure repayment remedies.

The Ultimate Guide To Payment Hub

Pay, Chum, for instance, is not subject to banking policies, so it can freeze your account Resources and also as a result your money at will (payment hub). Other negative aspects include high rates for some kinds of payment processing, limitations on the variety of transactions per day as well as quantity per purchase, and security openings. There's likewise a range of on the internet repayment handling software application (i.

An Unbiased View of Merchant Services

vendor accounts, occasionally with a repayment portal). These systems vary in their payments as well as integration possibilities some software application is much better for accounting while some fits fleet monitoring best. Another choice is an open source settlement processing platform. But do not consider this as totally free handling. An open resource platform still needs to be PCI-compliant (which sets you back around $20k annually); you'll have to deploy it and preserve a number of nodes; and you'll require to establish a connection with an obtaining bank or a payment cpu.A Biased View of First Data Merchant Services

They can additionally make your capital much more predictable, which is something that every local business owner pursues. Figure out more just how about B2B settlements work, and also which are the finest B2B repayment products for your small company. B2B repayments are payments made between 2 sellers for products or services.

The Greatest Guide To Online Payment Solutions

Individuals included: There are numerous Discover More individuals involved with each B2B transaction, including accounts receivable, accounts payable, invoicing, and also procurement groups. Payment delay: When you pay a pal or relative for something, it's commonly appropriate on-site (e. g. at the dining establishment if you're splitting an expense) or simply a few hours after the event.Taking into account the intricacy of B2B settlements, a growing number of organizations are choosing you can check here trackable, electronic repayment options. Fifty-one percent of companies still pay by check, declining from 81% in 2004. And also 44% of companies still obtain repayment by check, declining from 75% in 2004. There are 5 major methods to send out and also receive B2B settlements: Checks This classification includes typical paper checks and also electronic checks released by a customer to a vendor.

Merchant Services Can Be Fun For Everyone

Electronic financial institution transfers These are settlements in between banks that are transmitted via the Automated Clearing Up Residence (ACH). This is one of the most safe and trustworthy settlement systems, but financial institution transfers take a couple of days longer than cord transfers.Each option varies in ease of usage for the sender as well as recipient, price, and also safety. That stated, a lot of organizations are moving away from paper checks and also relocating toward digital and also digital settlements.

An Unbiased View of Fintwist Solutions

Repayments software and applications have reports that provide you an overview of your accounts receivable as well as accounts payable. If there a couple of sellers that regularly pay you late, you can either enforce stricter target dates or stop functioning with them. B2B payment solutions also make it easier for your clients to pay you, assisting you get repayment much faster.Report this wiki page